gm gardeners, 👨🌾

In this blog post, we share a peek into the walled garden we are building — a secure ecosystem protected from the dark forest, where we achieve Nash equilibrium among participants through positive-sum interactions.

Ethos

Seasons serve as a gateway to enter the walled garden. If seasons is how you entered, market making and staking is how you nourish your garden.

The walled garden is designed to protect all the participants inside it from the actors that unfairly extract value out of a user’s order flow. It is built to achieve these goals:

- An open system where anyone can participate and play different roles

- Incentivise long-term participation

- Include and create positive-sum effects for participants

- Improve user experience by providing best-in-class prices and time

Actors

The walled garden creates opportunities for new actors (fillers and stakers) and creates new value for the existing ones.

Users

Any person (or bot) who wants to use Garden to swap assets has their order flow protected from MEV bots, sandwiching bots, and all other parasite systems. The walled garden guarantees order execution once it is filled (or receive a 1% inconvenience fee), something no other DEX currently offers. Prices are optimised for the user through a meritocratic system to balance which fillers have a higher impact on the overall Garden UX.

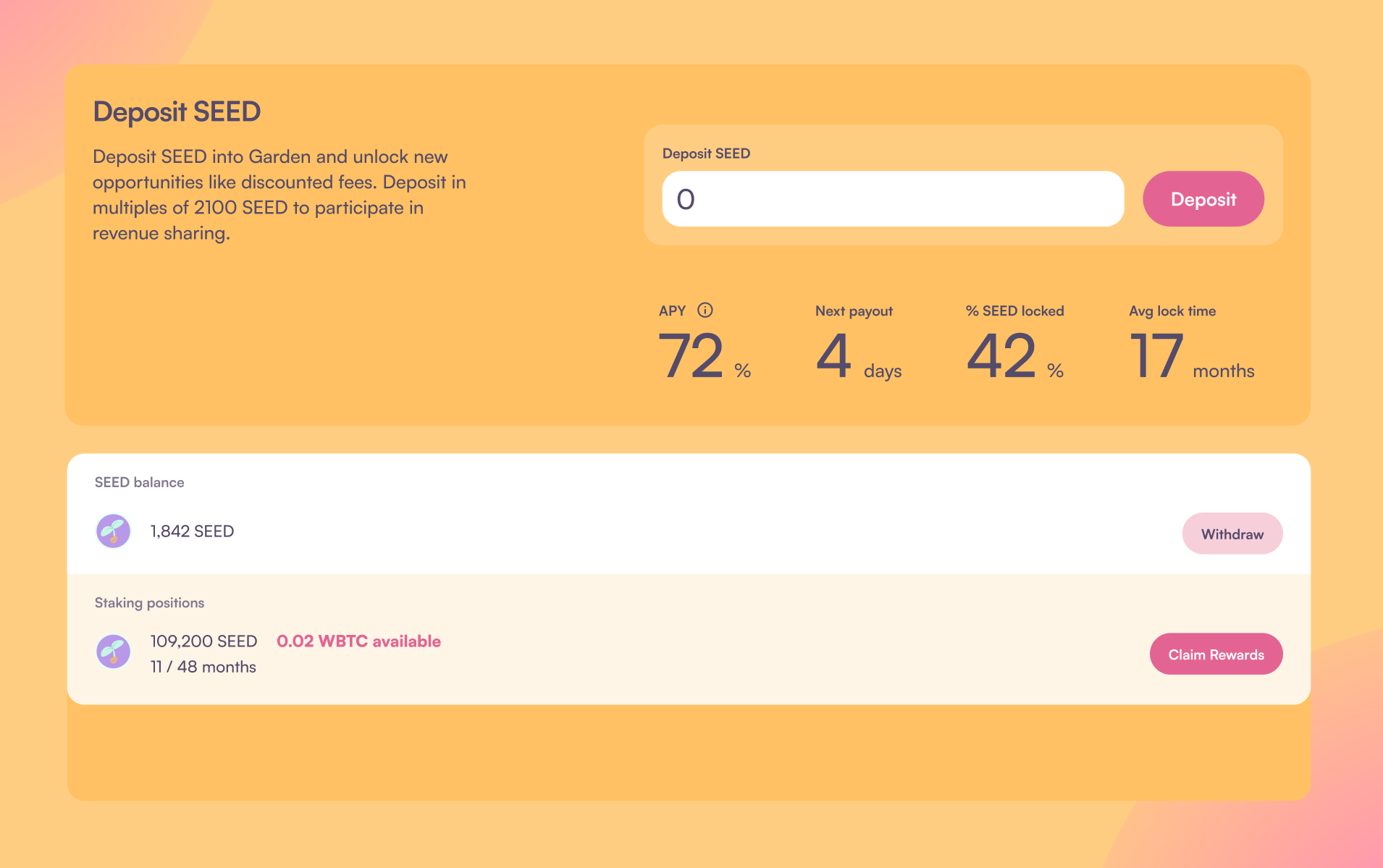

Users can deposit and maintain a SEED balance inside Garden to pay discounted fees. This benefits the system holistically, as it is achieved through off-chain batching of transactions by a relayer, hence decreasing the cost per transaction execution. The fee that gets paid in SEED is settled (can be claimed) by fillers and stakers instantly or used as a fee for their own trades, unlike fees in other assets that are settled once per week (see Stakers).

Fillers

Gardeners can become fillers in the walled garden by bonding 210,000 SEED. Registered fillers get access to facilitate Garden’s order flow and receive the fee paid by the respective user. To be an efficient filler, a gardener should be able to run arbitrage bots, have accessible funds to provide liquidity, have tools/strategies to rebalance liquidity, and the technical know how of running these bots with no down time.

The amount of volume fillers do is directly proportional to how efficiently they can execute orders. Efficiency is measured as the amount of fees a filler can pay to its stakers. A filler can promise X bips as the fee on the total weekly volume they do. So, the fee is success-based, dependent on the volume fillers settle. Thus incentivising fillers to build optimised bots and earn more. The fillers reach Nash equilibrium by paying as high of a fee as possible, as that would allow for the economies of scale to kick in and makes for optimal returns. Grim triggering is disincentivised by assigning volume thresholds per filler based on how efficiently they work.

If staker fees aren't paid promptly, responsible fillers are blocked for 7 days. If the fee remains unpaid during this grace period, their bond is grieved to their stakers. If a filler fails to settle an order within the allocated time, their bond gets slashed by 0.67% of the trade value. As the system evolves, more qualitative metrics are considered for slashing and measuring filler efficiency.

Stakers

Stakers are decision makers in the walled garden that balance how order flow is assigned to fillers in the system, by actively voting for efficient fillers. If a filler gets 80% of the votes, they get ROFR for 80% of the volume at the best price offered by the eligible fillers.

Stakers maintain equilibrium by preventing any one filler from gaining a monopoly. Voting for underdogs carries slight risk but offers higher APY and vice-versa, preventing dominance and price manipulation. The voting system also minimises grim triggering, ensuring no gains from such strategy.

Staking for a filler means having their skin in the game. If a filler fails to settle an order within the allocated time, 0.33% of the trade value gets slashed from the stakes of their stakers. Hence, stakers must strike a balance, optimising between fillers that offer high payouts and minimise losses from slashing.

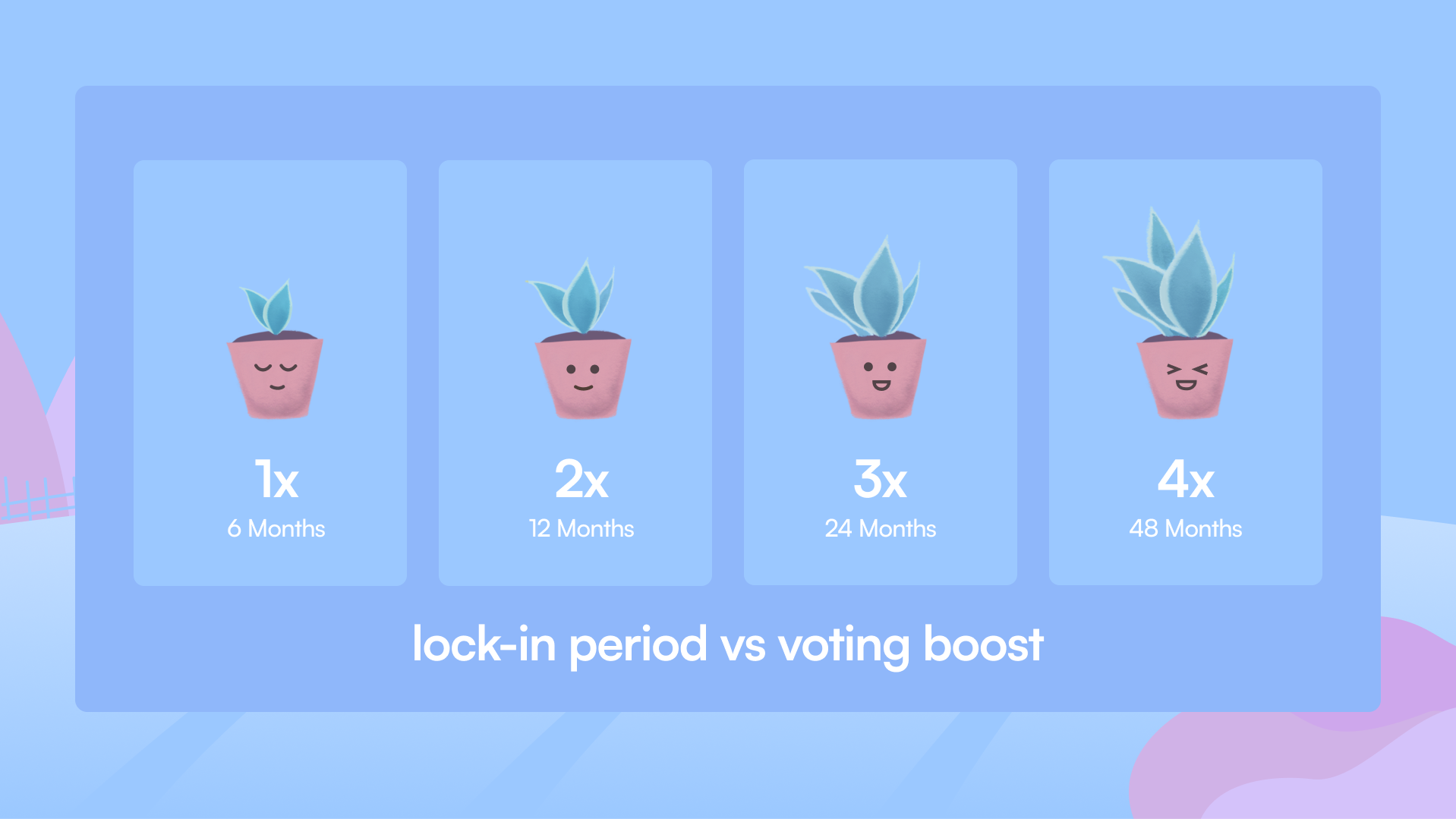

Long term commitment of stakers is incentivised by boosting their voting/earning capability. Staking for 6 months gets 1 vote for that period, while staking for 4 years means 4 votes for the entire duration, resulting in 4x the APY compared to someone staking for 6 months at a time.

Order Allocation Process

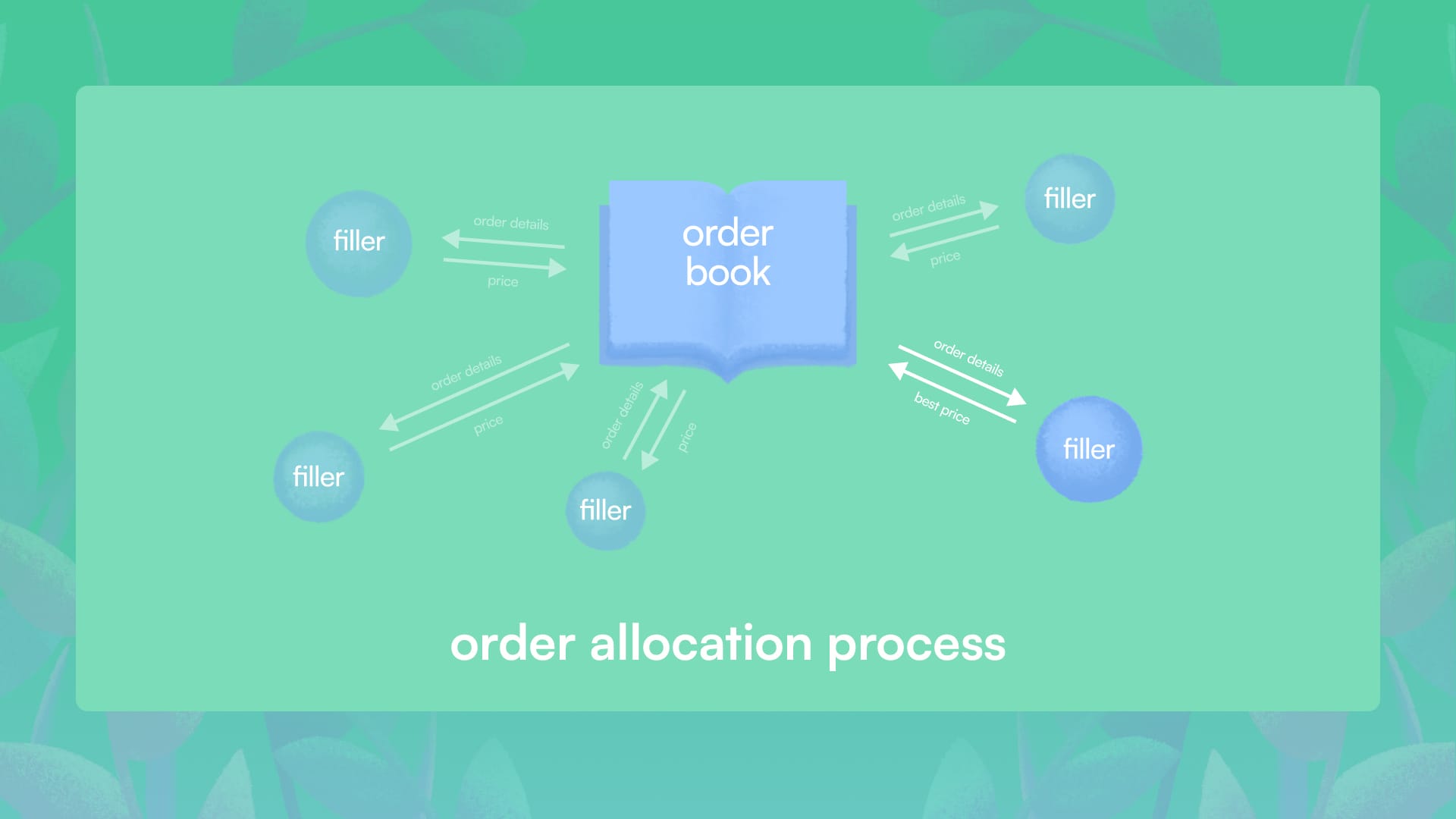

Here is a rundown of what happens once a user creates an order:

- The Garden order book (OB) emits the order details to all the eligible fillers. This stage is marked by 'order matching' in the UI.

- Fillers respond with the best price they can offer.

- The OB identifies the best price among all filler responses and communicates it back to all fillers.

- If only one filler accepts, they fill the order, signified by a 'order matched' message in the UI.

- If multiple fillers accept the new price,

- For staker-users, their orders are assigned to the fillers they staked towards. An additional discount of 0.1 bips per vote (up to the filler's maximum fee) is applied, subtracted from the fees stakers receive.

- A ratio is calculated comparing the proportion of stakers to the proportion of the order filled. The filler with the lowest ratio is assigned the order.

- Only the assigned filler(s) expend costs for filling and the cost of failure for the participating fillers is zero. This creates a positive-sum effect for fillers as in any other arbitrage scenarios like sandwiching, all the participants expend funds and end up with failure costs.

- This creates a positive-sum effect for fillers as in any other arbitrage scenarios like sandwiching, all the participants expend funds and end up with failure costs.

- After matching, the user initiates the asset deposit into the HTLC contract and the filler bot observes for a fixed amount of confirmations.

- Subsequently, the filler gets a fixed time window to deposit their asset. If the filler doesn't execute in time, users receive an inconvenience fee.

- User and filler can then redeem each other's assets, completing the trade.

Audit and Release

The development of required smart contracts and off-chain components are complete. We are currently pursuing a security audit with Trail of Bits which is expected to be take until the third week of February. The launch dates of staking and market making features will be made public in a couple of weeks as we reach the final stages of audit. In the meantime, we have a number of cool features, and quality of life improvements planned.

Staking Rewards

Currently, the active filler is run by our close partners. Profits earned till date will be distributed amongst active fillers and stakers on a weekly basis over 10 weeks following staking launch.

Assuming 20% of SEED is staked, at current market prices this would provide an APY of 71% → 284% based on lock-in period.

The Future

As mentioned earlier in the blog, this program is how we envision the Garden ecosystem to thrive. The purpose of the walled garden is to be a positive-sum endeavour for all the actors involved.

Staking and market making become much more interesting as we add support for more assets and chains in our pursuit of the perfect DEX. This also creates exciting possibilities for MEV capture and redistribution giving all the more reasons for users to choose to enter the Garden.

we're just getting started 🌱

About Garden

Garden is the fastest way to swap BTC and WBTC, providing a 10x improvement over existing options. It is decentralized, trustless, audited and not a real garden.

Join our garden townhall to chat with other gardeners about soil acidity and trimming bushes.