Bitcoin-Backed Loans on Sats Terminal

Ecosystem

21 January, 2026

What is Sats Terminal

Sats Terminal is a Bitcoin defi aggregation protocol that integrates fragmented opportunities; including staking, token swaps, borrowing, and bridging, into a seamless unified experience. Backed by Coinbase Ventures, YZi Labs, and Draper Associates, Sats Terminal aims to make Bitcoin as productive as it is valuable.

The Challenge

For longterm Bitcoin holders, selling means missing out on future upside. Lending provides an alternative, the ability to borrow against Bitcoin holdings, unlocking liquidity while preserving exposure. But accessing cross-chain lending markets requires users to navigate multiple bridges, wrapped tokens, and custodial risks.

Sats Terminal needed native Bitcoin execution for their lending aggregator without forcing users through complex bridge flows or giving away custody.

Solution

Sats Terminal integrated Garden via the API to power cross-chain Bitcoin execution for their borrowing aggregator. Their platform continues to handle loan aggregation, rate comparison, and user interface, while Garden executes the underlying Bitcoin movements non-custodially.

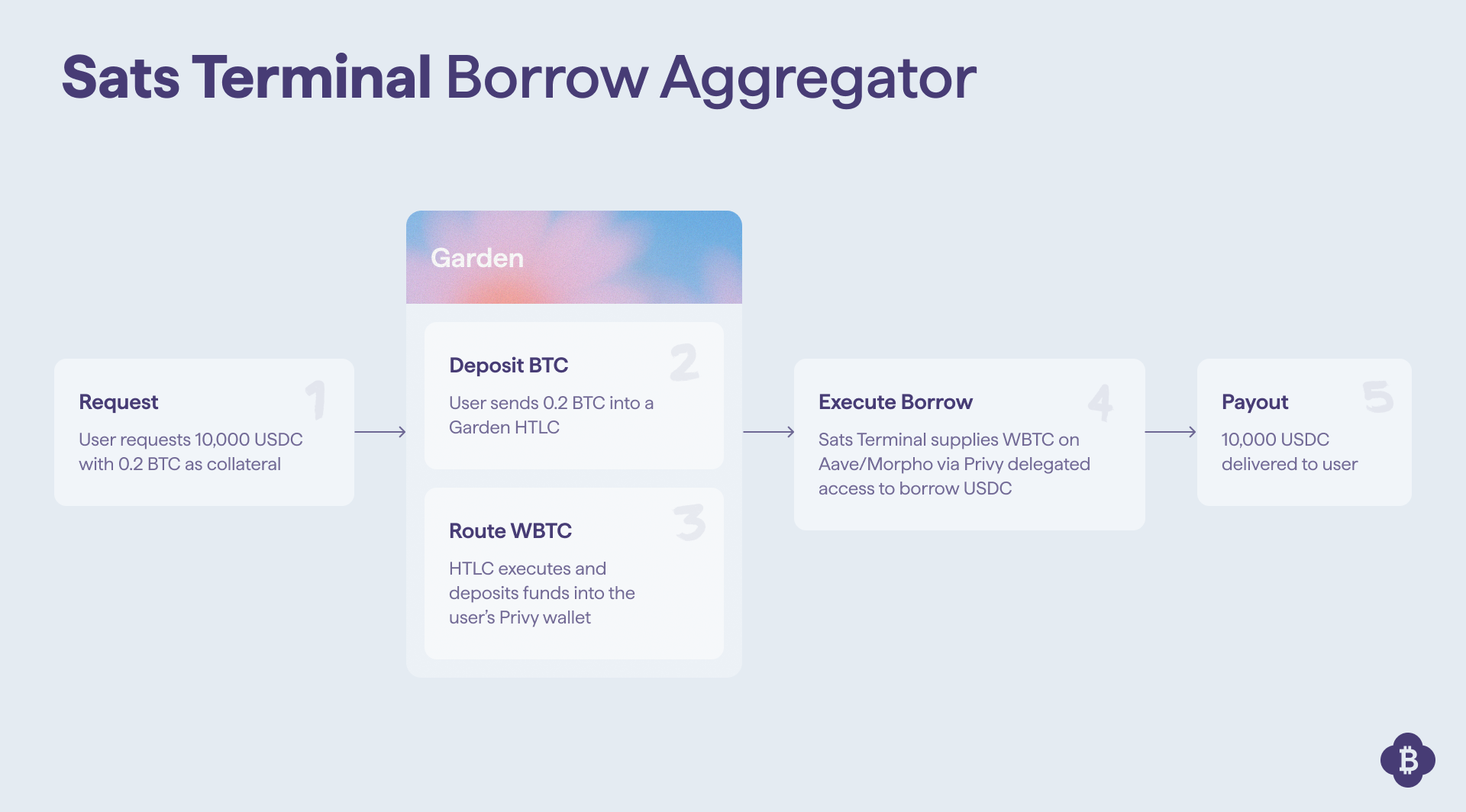

Order Flow

Here's how a Bitcoin-backed loan works on Sats Terminal:

Flow breakdown:

- User sends BTC from their wallet to a one-time HTLC deposit address powered by Garden.

- BTC is atomically exchanged with an independent solver via the Garden API.

- WBTC is supplied as collateral in Aave/Morpho, etc., to open a user's loan.

- USDC is sent to users' Sats Terminal wallet (powered by Privy).

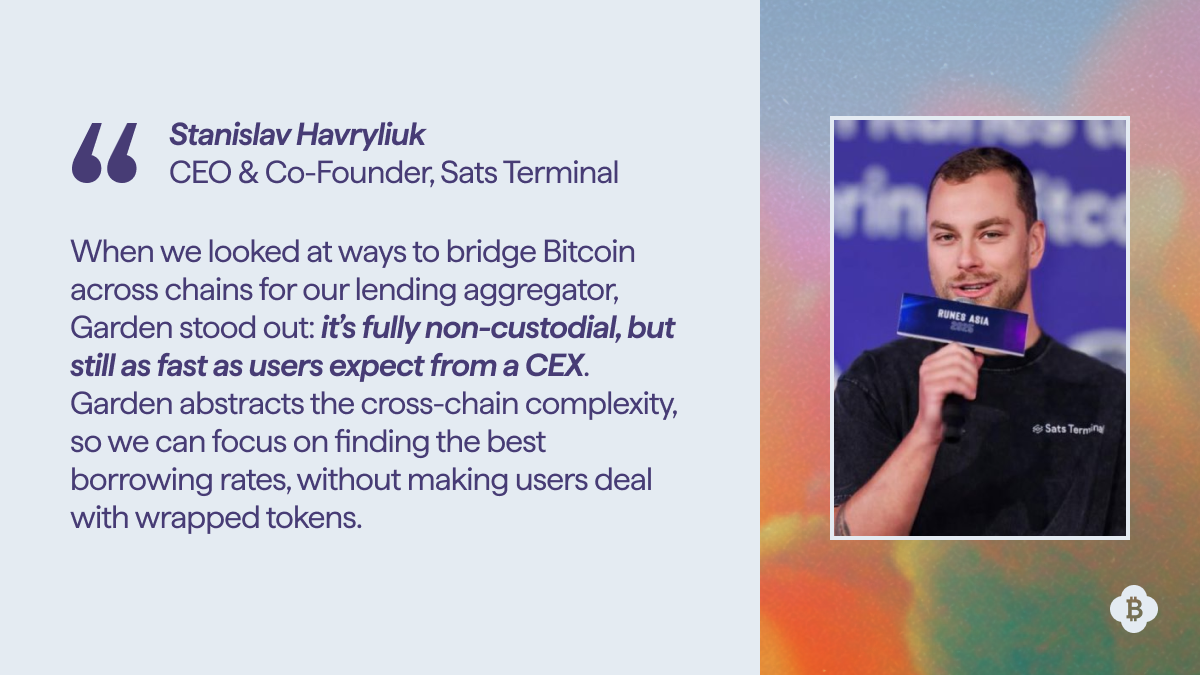

Why Garden

We asked the Sats Terminal team why they chose Garden. Here's what they had to say:

Atomic swap architecture

No wrapped token minting, Garden executes transactions via HTLCs and an independent solver network, using the existing inventory of wrapped assets in the market.

Non-custodial execution

Garden never holds users' Bitcoin; users remain in control throughout the process.

API flexibility

We chose Garden’s APIs to keep execution logic in the backend, enabling orchestration with Temporal, making multi-step flows easier to manage.

Sub-30s execution

Competitive with CEX withdrawal times while maintaining full decentralization. For example, a transaction from USDT/USDC on any chain to Bitcoin takes under 30 seconds after the user initiates on the source chain.

Key Takeaways

- Garden serves as the Bitcoin to wrapped variants execution layer for cross-chain lending, not the lending protocol itself

- API integration enabled Sats Terminal to add Bitcoin borrowing without building custom bridge infrastructure

- Native BTC collateral support added without managing wrapped tokens or bridge liquidity

Ready to add native Bitcoin to your app? Start building with Garden →

Last updated on 26 February, 2026